What is HomeSave

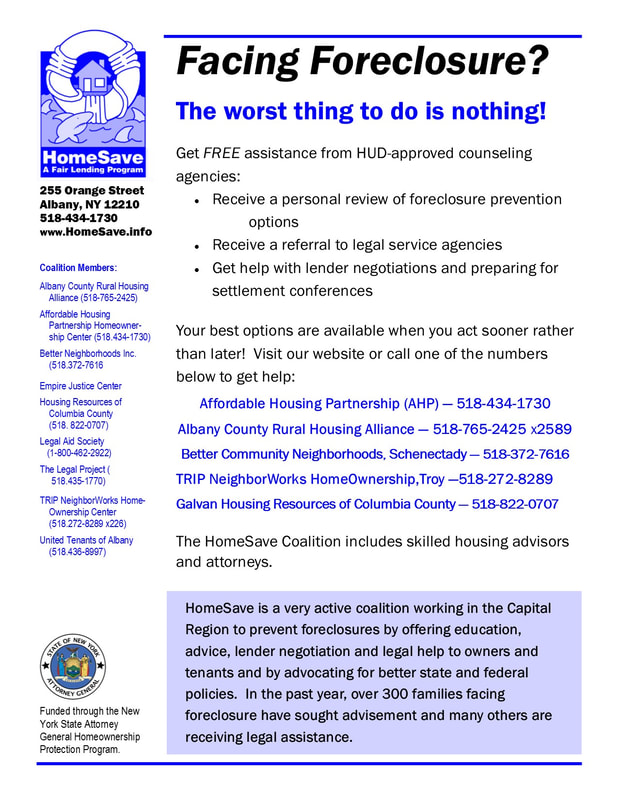

HomeSave is a foreclosure prevention initiative that helps homeowners prevent and solve problems with delinquent or costly mortgages.

Thanks to our many HomeSave partners, we offer homeowners in the Capital District a wide range of resources, including:

|

Homeowner Information WebinarBehind on your mortgage payments or in a forbearance? There are options available to you to get current again, or to successfully exit your forbearance plan. Check out the March 2021 session below of our free Homeowner Information webinar. You can also always reach out to a HomeSave partner to find out more about your options.

.

Help For Homeowners in the City of Albany

and Town of Colonie Thanks to CDBG CARES funds there are special financial assistance programs to assist residential property owners. If you have been unable to pay your mortgage or property taxes due to COVID, earn less than 80% of median income, and will be able to resume payments, you can apply for the City of Albany or Colonie financial relief program. Contact AHP Homeownership Center at 518-434-1730 x401. |

HomeSave Coalition Partners

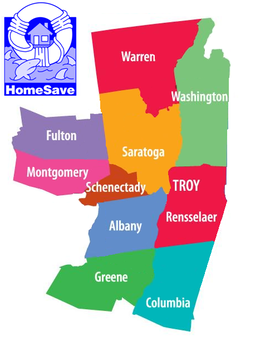

Where We Serve

Funded through the New York State Attorney General Homeownership Protection Program |

Mortgage ForbearanceIf you are facing financial hardship, contact your servicer about the possibility of a mortgage forbearance. This will pause payments until you can afford to start payments again. If you are in a forbearance and nearing the end and still having difficulties, contact your servicer about an extension. Options may depend on the type of mortgage you have. Contact a HomeSave member for help. Additional information is at the Consumer Financial Protection Bureau website.

If you are ready to exit your forbearance, you have several options:

Beware of Scams!The FTC warns of several Coronavirus Scams. Visit their website for more information

1. Contact Tracing Legitimate tracers need health information, not information on money or personal financial information 2. Calls, emails, texts from the IRS The IRS won't contact you by phone, email, text message or social media with information about a stimulus check. You don't have to pay to get your stimulus money. 3. A fake agency asking for your Social Security number Beware of a scam involving social media messages taking users to a fake website called the "US Emergency Grants Federation" and asks for your Social Security number to verify your eligibility, 4. Ignore offers for vaccinations, miracle treatments, test kits. Scammers are selling products that have not been proven to work. 5. Any correspondence claiming to be the Treasury Department The IRS is a bureau of the Treasury Department, and most often gets in touch with taxpayers via mail. In the case of the stimulus checks, the IRS is relying on direct deposit information provided on recent tax returns to send out payments. "If you receive calls, emails, or other communications claiming to be from the Treasury Department and offering COVID-19 related grants or stimulus payments in exchange for personal financial information, or an advance fee, or charge of any kind, including the purchase of gift cards, please do not respond. These are scams," the Treasury Department warns on its website. 6. Emails from the CDC or WHO Instead of clicking on links in emails from sources you don't know, directly visit sites such as www.coronavirus.gov to get the latest information. FTC: www.ftc.gov Consumer Financial Protection Bureau: www.consumerfinance.gov |

|

Funded through the New York State Attorney General Homeownership Protection Program |